Economics

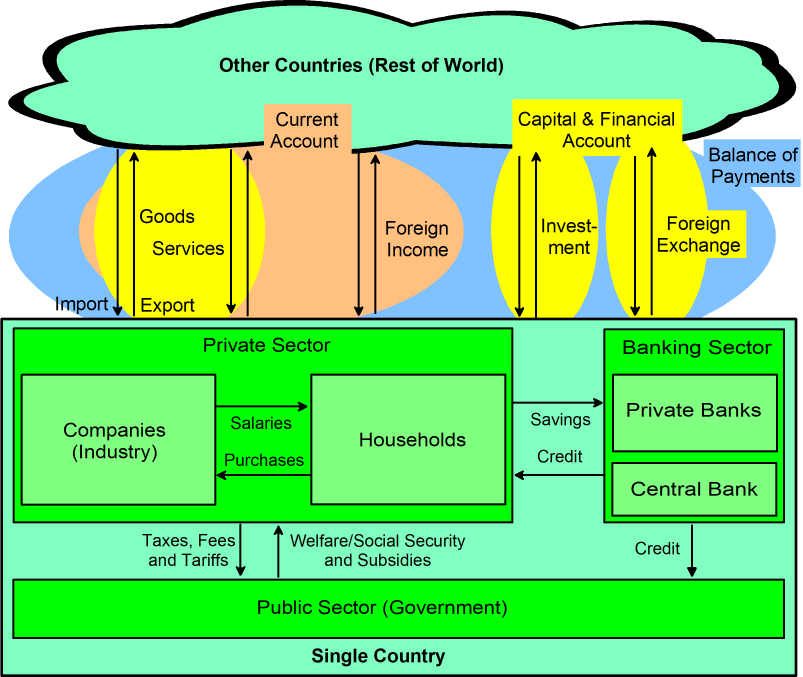

In times of growing economic uncertainty, trade wars and tariffs, everybody should have a basic idea about how the economy and economic accounting works. Within each country we basically have four major economic actors (Fig. 1):

- Private companies, i.e. entrepreneurs and their workforce, produce goods and services. In economic terms they create value.

- These goods and services are consumed by private households, which generate the required income by working for these companies (or for the public sector).

- Financial transactions are handled via the banking system.

- The government (public sector) establishes the rules under which these actors are operating. Additionally it is responsible for maintaining internal and external security via the police, the justice system and the military and to provide public infrastructure like roads, schools, and social security. The public sector generates the required income by taxing the private sector and collecting tariffs for imports. If income is not sufficient, it takes credit by issuing government bonds.

Each country must import goods and services, e.g. energy, which it does not have on its own soil. To pay for these imports, the country needs to export a similar amount of other goods and services. If a country does not have enough goods and services to export, the country may force part of its population to work in other countries and send money home (foreign income). Economists summarize these activities between a country and the rest of the world as:

Current Account (Leistungsbilanz) = Balance of Trade (Goods) and Services + Balance of Foreign Income

If a country has a current account surplus, i.e. it earns more from exports than it has to pay for imports, the country may export capital, i.e. it invests in foreign companies either directly or via stocks or bonds (credit, debt). The technical term for this balance is Capital & Financial Account. If the country does not invest this surplus abroad, its central bank may keep the excess income as foreign exchange (FX) reserves (often in USD or gold). Countries with current account deficits will need capital imports and/or sell their FX reserves. Economists describe this relation as:

Balance of Payments (Zahlungsbilanz) = Current Account (Leistungsbilanz) + Capital & Financial Account (Kapitalbilanz) incl. FX Reserve Balance (Devisenbilanz) = 0

As you can see this is an accounting identity, i.e. the sum of the the terms is zero, meaning a surplus in one account must be balanced by a deficit in another account.

To measure the economic power of a country, economists use the annual

Gross Domestic Product GDP (Bruttoinlandsprodukt BIP) = Consumption (of the private sector) + Investments (of the private sector) + Government spending + Balance of Goods (Trade) and Services (Exports - Imports)

Major Economic Regions

The world consists of 4 major economic regions:

- North America with the US as the dominating economy, Canada as its natural resource and Mexico as its emerging manufacturing hub.

- Asia Pacific with China and Japan as the dominating economies, surrounded by a lot of smaller ones like Australia or South Korea and India as an emerging giant.

- Europe with Germany, France, Italy, Spain and other members of the EU and its associated countries like Great Britain.

- Energy and Commodity Countries in the Middle East, Latin America, Africa and Russia.

While internal trade dominates in the first 3 regions, interregional trade still has a prominent role. North America with the US is a major importer for goods from China and the EU, creating trade deficits indicated by the negative values in Table 1. While China has been an important export market for German products, the EU as a whole imports more from China than it exports.

By strategically exploiting its own oil and natural gas resources, North America now is independent and has even become a net exporter of energy. The EU, China and Japan however still depend on large energy and commodity imports.

| US | EU | China | |

| Export of Goods and Services | S 3190 B | $ 3250 B | $ 3920 B |

| Import of Goods and Services | $ 4110 B | $ 2900 B | $ 3100 B |

| Balance vs Rest of World | - $ 920 B | + $ 350 B | + $ 820 B |

| Balance vs EU | - $ 150 B | ||

| Balance vs China | - $ 260 B | - $ 280 B | |

| GDP | $ 29 200 B | $ 19 500 B | $ 18 700 B |

| People | 340 M | 450 M | 1400 M |

| Net Energy Exports | + $ 100 B | - $ 400 B | - $ 350 B |

Controlling Exports and Imports

The strategy to export more goods and services to another country is the same as the sales strategy for an individual company:

- Have a unique product, which nobody else does offer, but which others urgently need. This is the situation e.g. for so-called rare earths, where China has some 90% of the world's refining capacity. For the seller this is the optimal situation.

- Have a product, which has a better quality or more features, for which others are willing and able to pay. This e.g. was the selling point for German premium cars. For the producer this is an acceptable situation, but requires constant effort not to loose its competitive advantage.

- Have a me-too product, but offer it at a cheaper price than your competitors. This is by far the worst situation for the seller.

Unfortunately, most products today fall into the latter category. What to do, if you need to increase exports for price sensitive products:

- Increase productivity to reduce production cost e.g. by more automation or by lowering wages. The latter will only be accepted in extreme economic situations and rarely encouraged by governments. Thus companies often do this by moving production to lower wage countries. Governments can help, by reducing taxes or relaxing regulations. Nothing to expect on a larger scale ...

- To avoid or at least delay the need for internal measures a whole country may devalue its currency versus the currency of its customers. If the local currency becomes cheaper, the price from the perspective of the foreign customer will decrease, even if it is unchanged on the local base of the producing country. Unfortunately, if you devalue your currency to help your exports, your imports become more expensive. To get a net positive effect, the country should also reduce its imports.

- Establish or increase tariffs on imports of competing products. Obviously this has no direct effect on your exports, but by making imports more expensive, people in your country are more likely to purchase local products. So local production goes up and may also create new jobs. And additionally, when total imports go down, so does the need for exports. The Trump administration comes to mind ...

Special Role of the US

...

FX Exchange Rate

...

Credit Creation and Debt - Banks and Central Banks

...

Demographics

...

to be continued ...