Macroeconomics

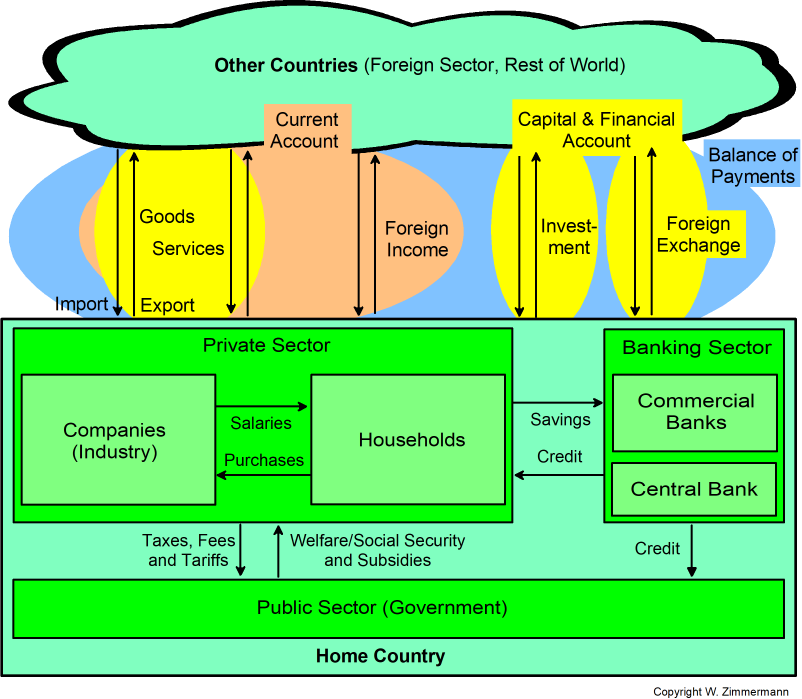

In times of growing economic uncertainty, trade wars, and tariffs, everyone should have a basic idea of how the economy and economic accounting work [ref. 2, 3]. Within each country, we basically have four major economic actors (Fig. 1):

- Private companies, i.e., entrepreneurs and their workforce, produce goods and services. In economic terms, they create value.

- These goods and services are used by private households, which generate the required income by working for these companies (or for the public sector). In economic terms, they consume value.

- Financial transactions are handled through the banking system.

- The government (public sector) establishes the rules under which these actors operate, is responsible for maintaining national security through the police, the justice system, and the military, and provides public infrastructure such as roads, schools, and social security. The public sector generates its income by taxing the private sector and collecting tariffs on imports. In economic terms, it both consumes and redistributes value. When income is not sufficient, the government borrows by issuing government bonds.

Each country interacts with other countries via trade and financial transfers. So we have a fifth actor, sometimes called the foreign sector.

GDP and other Important Economic Terms

Each country must import goods and services, such as energy, that it does not produce domestically. To pay for these imports, the country must export a similar amount of other goods and services. If a country does not have enough goods and services to export, the country may force part of its population to work in other countries and send money home as foreign income. Economists [ref. 1] describe these activities between a country and the rest of the world by the Current Account:

Current Account (Leistungsbilanz) = Balance of Trade in Goods and Services + Balance of Foreign Income

If a country has a current account surplus, i.e., it earns more from exports than it pays for imports, the country may export capital by investing in foreign companies directly or through stocks or bonds (credit, debt). The technical term for this balance is Capital & Financial Account. If the country does not invest this surplus abroad, its central bank may hold the excess income as foreign-exchange (FX) reserves (often in USD or gold). Countries with current account deficits will need capital imports and/or must sell their FX reserves. Economists [ref. 1] describe this relationship as the Balance of Payments:

Balance of Payments (Zahlungsbilanz) = Current Account (Leistungsbilanz) + Capital & Financial Account (Kapitalbilanz) incl. FX reserve balance (Devisenbilanz) = 0

As you can see, this is an accounting identity, i.e. the sum of the terms is zero, meaning a surplus in one account must be balanced by a deficit in another.

To measure the economic power of a country, economists [ref. 1] use the annual GDP

Gross Domestic Product GDP (Bruttoinlandsprodukt BIP) = Consumption of the private sector + Investments of the private sector + Government spending (not including transfer payments) + Balance of Trade in Goods and Services (Exports - Imports)

GDP sums the total value of all final goods and services produced inside the country. Imports are subtracted because both the consumption and investment terms in the equation contain domestic and imported items. By definition, only domestically created value should be counted, and thus imports must be subtracted.

The GDP is equivalent to the income, which the economy generates. It can be used for consumption or for savings and without it we would not be able to pay our taxes:

Gross Domestic Product GDP = Consumption of the private sector + Savings of the private sector + Taxes paid by the private sector

Both formulas describe the same GDP. So we can set them equal and rearrange the result:

Savings - Investments + Taxes - Government spending = Export - Imports

The first difference on the left side of the equation describes the private sector's net income, the second difference describes the government's net income and the right side of the equation is the net income earned from the foreign sector, i.e. the trade balance.

While GDP measures a country's economic power over the past year, the Net International Investment Position NIIP measures the financial wealth it accumulated in other countries to date:

Net International Investment Position NIIP = Value of all Foreign Assets a Country Owns - Value of all Assets in a country Owned by Foreigners

Financial assets include companies, stocks, government and corporate bonds, loans, and real estate.

A positive NIIP means that a country owns more assets abroad than it owes own assets to foreigners. However, a negative NIIP is not necessarily a sign of a debtor country. It can also reflect that a country's financial assets are more attractive to foreigners than those of their home countries.

Note: Be careful when politicians label a project as an investment, because in the ears of voters this sounds better than consumption. For example, when a government buys military equipment. There may be valid reasons for such a purchase, but it is not an investment. In economic terms, an investment is money spent in the hope that it will generate future income. Tanks and fighter jets don't ...

Major Economic Regions

The world consists of four major economic regions:

- North America, with the US as the dominant economy, Canada as its natural resource supplier, and Mexico as its emerging manufacturing hub.

- Asia-Pacific, with China and Japan as the dominant economies, surrounded by many smaller ones like Australia or South Korea, and with India as an emerging giant.

- Europe, with France, Germany, Italy, Spain, and other members of the EU and its associated countries, such as the United Kingdom, Norway or Switzerland.

- Energy and commodity countries in the Middle East, Latin America, Africa, and Russia.

While internal trade dominates in the first three regions, interregional trade still plays a prominent role. North America, with the US, is a major importer of goods from China and the EU. These trade deficits are indicated by the negative values in Table 1. The large deficits which the US runs in goods, are partly compensated by a surplus in services.

China has been an important export market for German products, but the EU as a whole imports more from China than it exports.

By strategically exploiting its own oil and natural gas resources, North America is now independent and has even become a net exporter of energy. However, the EU, China, and Japan still depend on large energy and commodity imports.

| US | EU | China | |

| Exports of Goods and Services | $ 3190 B | $ 3250 B | $ 3920 B |

| Imports of Goods and Services | $ 4110 B | $ 2900 B | $ 3100 B |

| Balance vs Rest of World | - $ 920 B | + $ 350 B | + $ 820 B |

| Balance vs EU | - $ 150 B (Goods -$240B, Services +$90B) | ||

| Balance vs China | - $ 260 B | - $ 280 B | |

GDP (% of World GDP) | $ 29 200 B (26%) | $ 19 500 B (18%) | $ 18 700 B (17%) |

Population (% of World Population) | 340 M (4%) | 450 M (5.5%) | 1400 M (17%) |

| Net Energy Exports | + $ 100 B | - $ 400 B | - $ 350 B |

| NIIP | - $ 26500 B | + $ 1020 B | + 3300 B |

Related Posts

Literature References:

- AIER (American Institute for Economic Research): Understanding Trade Balances, Jan. 2025

- CFR (Council on Foreign Relations): The U.S. Trade Deficit, April 2025

- Lyn Alden: A Trade Breakdown, May 2025

- Lyn Alden: Why Trade Deficits matter, Oct. 2019

- Stephen Miran: A User's Guide to Restructuring the Global Trade System, Nov. 2024